Muqe

New member

Why Are Pharma Stocks Rising?Yesterday, I was reading the second part of Amish Tripathi's famous Shiva Trilogy - The Oath of The Vayputras. I came across an interesting quote in the book that read,

“What is forgotten, however, is that many times the good we create leads to the evil that will destroy us.”

I couldn't help but compare it to the current covid-19 outbreak in China. Allow us to explain…

Nearly 37 million (m) people might have been infected with the virus in a single day in China which would make the country's outbreak by far, the world's largest.

In China's National Health Commission internal meeting, it was estimated that nearly 18 per cent of the population (approximately 248 m people), were infected by the virus in the first 20 days of December.

But how did this happen so quickly?

Well, China is in this dreadful situation because of its “zero covid policy”. It involves complete control and maximum suppression for the elimination of the virus by using aggressive public health measures, such as contact tracing, social isolation, mass testing, and lockdowns.

The lockdown in China in March 2022 is a classic example of the strict implementation of the zero covid policy. Initially, this strategy seemed to be very successful because there was very limited spread of the disease in the country.

However, a few days ago, this policy was lifted and China clearly did not plan its exit from the zero covid policy. As soon as the restrictions were removed, there has been an outbreak of infections.

As Chinese people were not exposed to the coronavirus at all, they do not have the immunity to fight the disease. Hence, the rapid spread of infections.

So, the good that China created (zero Covid policy) has led to the evil that is destructive right now. China is possibly looking towards 1 m cases and 5,000 deaths per day.

It might be the biggest outbreak the world has ever seen.

Health experts believe that since other people around the globe are already vaccinated there might be lesser chances of the breakout having a severe impact on other countries.

However, they also acknowledge a possibility that the spread in China might lead to a new variant of the virus, which could put the health of global citizens in a jeopardy. Hence, governments across the world are warning people to be cautious.

Resultantly, the stock markets across the globe have suffered a severe fall owing to this outbreak, along with fears of interest rate hikes, recession, and lockdowns.

The 6 sectors most effected sectors by Covid are seeing a decline.

Just like there is an odd one out in every scenario, there is an odd one in the crashing market too.

No prizes in guessing as the odd one in this scenario is the pharma sector stocks.

Pharma stocks have started to rally amid renewed fears of Covid outbreaks. Continue reading to know more and whether there's any opportunity to lap up the best pharma stocks in India for you.

Good News For Pharma Stocks

For ease of understanding as to why pharma stocks are rallying, we've broken down the sector into different parts: 1. Drug stocks 2. Vaccine stocks and 3. Testing stocks.

All three segments are expected to benefit from the Covid outbreak in the following ways:

#1 Drug Stocks

During covid, two medicines were sold like hot chocolates. Ibuprofen and Paracetamol.

These two medicines were in high demand and so were the companies manufacturing them. However, as time passed and covid-19 fears eased, the demand for the two medicines fell.

As covid-19 fears once again rise, the market expects that these medicines will again sell at high rates. The immediate companies to benefit from the increasing demand for these medicines are IOL Chemicals and Granules India.

IOL Chemicals is the largest producer of Ibuprofen in the world! It has around 35% of the global market share. It is the only company worldwide that is backward integrated for all intermediates and key starting materials of Ibuprofen.

Ibuprofen is one of the highest revenue-earning segment for IOL Chemicals. For the financial year 2021-22, sales of Ibuprofen alone contributed to 30 per cent of the total revenues.

IOL Chemicals earns business from two segments - pharmaceutical segment and the chemical segment. For the year ended March 2022, IOL reported revenues at Rs 2,184 crore (about Rs 21.84 billion), around half of which came from the pharma segment.

For the quarter that ended 30 June 2022, its total revenue stood at Rs 5.4 billion (bn) out of which more than 55 per cent of revenue came from the pharma segment. So we can clearly see that IOL Chemicals earns a major chunk of its revenue from pharma sales.

Revenue Segmentation

In 2022, IOL also started the production of paracetamol.

When we speak of paracetamol, it would be a blunder to not mention Granules India. Granules India is one of the largest sellers of paracetamol in India.

Paracetamol's revenue forms a major part of its revenue. For the financial year 2021-22, the company earned a total revenue of Rs 37,649 million (m) out of which around 38 per cent of sales came from selling paracetamol.

The company also manufactures and sells Ibuprofen. Even Ibuprofen forms a significant portion, around 13 per cent of the total revenue.

Revenue Segmentation

In the second quarter of the financial year 2022-23, the company saw an increase in the sale of paracetamol in the US and Europe.

So, IOL Chemicals and Granules India will see a huge rise in demand for their core products. Even if covid-19 outbreak stays confined to China, these companies will easily benefit from the outbreak because of their huge market share.

The secondary beneficiary of the covid-19 outbreak will be Cipla, Glenmark Pharmaceuticals, and Linde India.

During the initial covid-19 phase, the two drugs in high demand apart from ibuprofen and paracetamol were respiratory-related drugs - Remdesivir and Favipiravir.

Owing to the high demand of Remdesivir in Covid times, Cipla share price was rising.

Cipla and Glenmark have a big presence in the market for the said drugs.

Coming to Linde India, a sudden drop in the oxygen level of patients led to high demand and a scary shortage of liquid oxygen in the country.

Linde India had a big role to play in helping cut down this shortage as it is one of the largest oxygen producers in the country.

During covid-19, the company tweaked its plants to produce as much liquid oxygen as possible. In most cases, it was able to enhance the production capabilities beyond what the plants were designed for.

It was producing around 2,500-2,600 tonnes of oxygen a day.

Now let's move on to the second segment…

#2 Path Labs

Every newspaper headline for the past two to three days was about the covid-19 outbreak. In between all these, there was a particular term that was common among all newspapers - ‘genome sequencing'.

Following China's covid-19 outbreak, Rajesh Bhushan, Union health secretary, wrote a letter to additional chief secretaries, principal secretaries, and state health state secretaries to carry out genome sequencing of all covid-19 samples.

Genome sequencing is a laboratory method that is used to determine the entire genetic makeup of a specific organism or cell type. This helps in finding any new variant of the coronavirus.

This means that pathology labs will need to carry out extensive testing of covid-19 samples.

Resultantly, the share price of diagnostic companies and path labs like Vijaya Diagnostic, Dr Lal Pathlabs, Vimta Labs, Metropolis Healthcare, and Thyrocare has surged.

#3 Vaccine Stocks

Finally, we have vaccine stocks.

India and its role in supplying vaccines had been applauded by the world. Even the White House coronavirus response coordinator Dr Ashish Jha appreciated India's role.

In a conference held at the White House in October 2022, Ashish Jha said,

“I think India is an important manufacturer of vaccines for the world. I mean not just for India itself, this is a really important thing.”

Hence, vaccine production and distribution is an important and emerging area of sale. The vaccine was produced by two unlisted companies namely Serum Institute of India and Bharat Biotech.

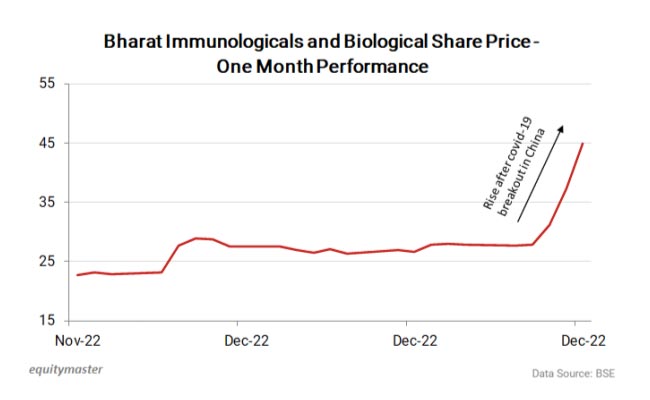

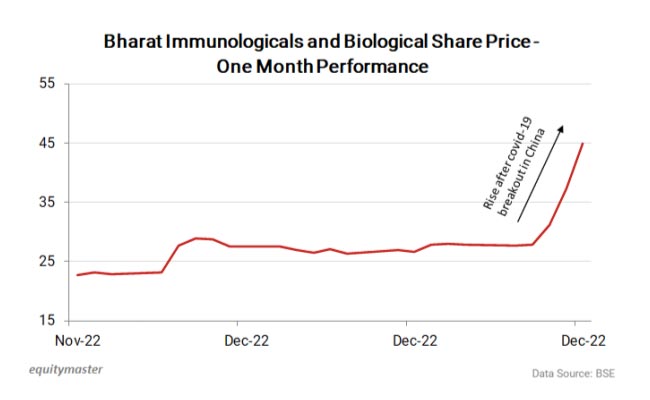

Now, this would normally not form a part of this article, but after the news of covid-19 outbreak in China was circulated, an unpopular and not so familiar stock saw a steep rise. The stock in question is Bharat Immunologicals and Biologicals Corporation (BIBCOL).

In the past few trading sessions, the share price has rallied around 63 per cent.

After connecting the dots, we found out that the company is engaged in the manufacturing of oral polio vaccine, zinc tablets, diarrhoea management kits, and BIB sweet tablets.

So, the company is engaged in the production of the vaccine but still nowhere related to the Covid-19 vaccine. However, in the company's annual report, it's mentioned that the company is also sanctioned to augment the production of the Covid-19 vaccine-- Covaxin -- in the country.

In 2021, Bharat Biotech signed a technology transfer pact to enable the production of Covaxin shots by BIBCOL and two other unlisted firms. BIBCOL had set February 2022 as the target date for the trial batch.

However, after that, there had been a gradual decrease in the need and demand for rampage production of Covaxin. So there was no further news about the company manufacturing Covaxin.

Investment Takeaway

Investors should keep in mind that these stocks are rallying because of market expectations. If covid-19 does not spread as the market expects, then the air driving the rally in these stocks may blow out.

Hence, an investor should carefully decide on time and risk appetite before investing in these stocks.

If we consider the long terms prospects of the Indian pharma sector, the pharma industry has a lot of scope for growth.

This notion is supported by FDI Investments in the Indian pharma sector. Foreign Direct Investment (FDI) inflows in the pharma sector (both pharmaceuticals and medical devices) during the current financial year from April 2022 to September 2022 stood at Rs 80.8 billion.

Industry experts believes that 2023 will be a good year for the sector given India's G20 Presidency. Digital health innovation, achieving universal health coverage and improving healthcare infrastructure and delivery will continue to be the key driving factors.

Indian Pharmaceutical Alliance (IPA) Secretary General Sudarshan Jain said that despite difficulties India has maintained its reputation as the 'pharmacy of the world'.

In 2023, reinvent and innovate will be the key mantra for Indian pharma players as the world looks forward to moving towards volume-to-value leadership.

Choosing a fundamentally strong pharma stock might be beneficial for an investor.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

“What is forgotten, however, is that many times the good we create leads to the evil that will destroy us.”

I couldn't help but compare it to the current covid-19 outbreak in China. Allow us to explain…

Nearly 37 million (m) people might have been infected with the virus in a single day in China which would make the country's outbreak by far, the world's largest.

In China's National Health Commission internal meeting, it was estimated that nearly 18 per cent of the population (approximately 248 m people), were infected by the virus in the first 20 days of December.

But how did this happen so quickly?

Well, China is in this dreadful situation because of its “zero covid policy”. It involves complete control and maximum suppression for the elimination of the virus by using aggressive public health measures, such as contact tracing, social isolation, mass testing, and lockdowns.

The lockdown in China in March 2022 is a classic example of the strict implementation of the zero covid policy. Initially, this strategy seemed to be very successful because there was very limited spread of the disease in the country.

However, a few days ago, this policy was lifted and China clearly did not plan its exit from the zero covid policy. As soon as the restrictions were removed, there has been an outbreak of infections.

As Chinese people were not exposed to the coronavirus at all, they do not have the immunity to fight the disease. Hence, the rapid spread of infections.

So, the good that China created (zero Covid policy) has led to the evil that is destructive right now. China is possibly looking towards 1 m cases and 5,000 deaths per day.

It might be the biggest outbreak the world has ever seen.

Health experts believe that since other people around the globe are already vaccinated there might be lesser chances of the breakout having a severe impact on other countries.

However, they also acknowledge a possibility that the spread in China might lead to a new variant of the virus, which could put the health of global citizens in a jeopardy. Hence, governments across the world are warning people to be cautious.

Resultantly, the stock markets across the globe have suffered a severe fall owing to this outbreak, along with fears of interest rate hikes, recession, and lockdowns.

The 6 sectors most effected sectors by Covid are seeing a decline.

Just like there is an odd one out in every scenario, there is an odd one in the crashing market too.

No prizes in guessing as the odd one in this scenario is the pharma sector stocks.

Pharma stocks have started to rally amid renewed fears of Covid outbreaks. Continue reading to know more and whether there's any opportunity to lap up the best pharma stocks in India for you.

Good News For Pharma Stocks

For ease of understanding as to why pharma stocks are rallying, we've broken down the sector into different parts: 1. Drug stocks 2. Vaccine stocks and 3. Testing stocks.

All three segments are expected to benefit from the Covid outbreak in the following ways:

#1 Drug Stocks

During covid, two medicines were sold like hot chocolates. Ibuprofen and Paracetamol.

These two medicines were in high demand and so were the companies manufacturing them. However, as time passed and covid-19 fears eased, the demand for the two medicines fell.

As covid-19 fears once again rise, the market expects that these medicines will again sell at high rates. The immediate companies to benefit from the increasing demand for these medicines are IOL Chemicals and Granules India.

IOL Chemicals is the largest producer of Ibuprofen in the world! It has around 35% of the global market share. It is the only company worldwide that is backward integrated for all intermediates and key starting materials of Ibuprofen.

Ibuprofen is one of the highest revenue-earning segment for IOL Chemicals. For the financial year 2021-22, sales of Ibuprofen alone contributed to 30 per cent of the total revenues.

IOL Chemicals earns business from two segments - pharmaceutical segment and the chemical segment. For the year ended March 2022, IOL reported revenues at Rs 2,184 crore (about Rs 21.84 billion), around half of which came from the pharma segment.

For the quarter that ended 30 June 2022, its total revenue stood at Rs 5.4 billion (bn) out of which more than 55 per cent of revenue came from the pharma segment. So we can clearly see that IOL Chemicals earns a major chunk of its revenue from pharma sales.

Revenue Segmentation

In 2022, IOL also started the production of paracetamol.

When we speak of paracetamol, it would be a blunder to not mention Granules India. Granules India is one of the largest sellers of paracetamol in India.

Paracetamol's revenue forms a major part of its revenue. For the financial year 2021-22, the company earned a total revenue of Rs 37,649 million (m) out of which around 38 per cent of sales came from selling paracetamol.

The company also manufactures and sells Ibuprofen. Even Ibuprofen forms a significant portion, around 13 per cent of the total revenue.

Revenue Segmentation

In the second quarter of the financial year 2022-23, the company saw an increase in the sale of paracetamol in the US and Europe.

So, IOL Chemicals and Granules India will see a huge rise in demand for their core products. Even if covid-19 outbreak stays confined to China, these companies will easily benefit from the outbreak because of their huge market share.

The secondary beneficiary of the covid-19 outbreak will be Cipla, Glenmark Pharmaceuticals, and Linde India.

During the initial covid-19 phase, the two drugs in high demand apart from ibuprofen and paracetamol were respiratory-related drugs - Remdesivir and Favipiravir.

Owing to the high demand of Remdesivir in Covid times, Cipla share price was rising.

Cipla and Glenmark have a big presence in the market for the said drugs.

Coming to Linde India, a sudden drop in the oxygen level of patients led to high demand and a scary shortage of liquid oxygen in the country.

Linde India had a big role to play in helping cut down this shortage as it is one of the largest oxygen producers in the country.

During covid-19, the company tweaked its plants to produce as much liquid oxygen as possible. In most cases, it was able to enhance the production capabilities beyond what the plants were designed for.

It was producing around 2,500-2,600 tonnes of oxygen a day.

Now let's move on to the second segment…

#2 Path Labs

Every newspaper headline for the past two to three days was about the covid-19 outbreak. In between all these, there was a particular term that was common among all newspapers - ‘genome sequencing'.

Following China's covid-19 outbreak, Rajesh Bhushan, Union health secretary, wrote a letter to additional chief secretaries, principal secretaries, and state health state secretaries to carry out genome sequencing of all covid-19 samples.

Genome sequencing is a laboratory method that is used to determine the entire genetic makeup of a specific organism or cell type. This helps in finding any new variant of the coronavirus.

This means that pathology labs will need to carry out extensive testing of covid-19 samples.

Resultantly, the share price of diagnostic companies and path labs like Vijaya Diagnostic, Dr Lal Pathlabs, Vimta Labs, Metropolis Healthcare, and Thyrocare has surged.

#3 Vaccine Stocks

Finally, we have vaccine stocks.

India and its role in supplying vaccines had been applauded by the world. Even the White House coronavirus response coordinator Dr Ashish Jha appreciated India's role.

In a conference held at the White House in October 2022, Ashish Jha said,

“I think India is an important manufacturer of vaccines for the world. I mean not just for India itself, this is a really important thing.”

Hence, vaccine production and distribution is an important and emerging area of sale. The vaccine was produced by two unlisted companies namely Serum Institute of India and Bharat Biotech.

Now, this would normally not form a part of this article, but after the news of covid-19 outbreak in China was circulated, an unpopular and not so familiar stock saw a steep rise. The stock in question is Bharat Immunologicals and Biologicals Corporation (BIBCOL).

In the past few trading sessions, the share price has rallied around 63 per cent.

After connecting the dots, we found out that the company is engaged in the manufacturing of oral polio vaccine, zinc tablets, diarrhoea management kits, and BIB sweet tablets.

So, the company is engaged in the production of the vaccine but still nowhere related to the Covid-19 vaccine. However, in the company's annual report, it's mentioned that the company is also sanctioned to augment the production of the Covid-19 vaccine-- Covaxin -- in the country.

In 2021, Bharat Biotech signed a technology transfer pact to enable the production of Covaxin shots by BIBCOL and two other unlisted firms. BIBCOL had set February 2022 as the target date for the trial batch.

However, after that, there had been a gradual decrease in the need and demand for rampage production of Covaxin. So there was no further news about the company manufacturing Covaxin.

Investment Takeaway

Investors should keep in mind that these stocks are rallying because of market expectations. If covid-19 does not spread as the market expects, then the air driving the rally in these stocks may blow out.

Hence, an investor should carefully decide on time and risk appetite before investing in these stocks.

If we consider the long terms prospects of the Indian pharma sector, the pharma industry has a lot of scope for growth.

This notion is supported by FDI Investments in the Indian pharma sector. Foreign Direct Investment (FDI) inflows in the pharma sector (both pharmaceuticals and medical devices) during the current financial year from April 2022 to September 2022 stood at Rs 80.8 billion.

Industry experts believes that 2023 will be a good year for the sector given India's G20 Presidency. Digital health innovation, achieving universal health coverage and improving healthcare infrastructure and delivery will continue to be the key driving factors.

Indian Pharmaceutical Alliance (IPA) Secretary General Sudarshan Jain said that despite difficulties India has maintained its reputation as the 'pharmacy of the world'.

In 2023, reinvent and innovate will be the key mantra for Indian pharma players as the world looks forward to moving towards volume-to-value leadership.

Choosing a fundamentally strong pharma stock might be beneficial for an investor.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)