Muqe

New member

How 5 Midcap Top Performers Are Set To Perform In 2023In cricket, there are winners such as Sachin Tendulkar and Virat Kohli, who are highly praised. And there are underappreciated or overlooked performers such as Rahul Dravid.

The analogy is, in the stock market, there are largecap stocks with more than 70% of the free-float marketcap getting the spotlight. And then there are underappreciated winners with a marketcap of 12-15%.

Even the most experienced investors sometimes overlook this significant portion of the stock market - midcap stocks.

Just like Goldilocks' chair, midcap stocks are "just right" for investors seeking a balance between growth and profitability.

If your portfolio already holds a lot of smallcap and largecap companies, adding midcap stocks can be just right to diversify your portfolio.

Here's a deeper look at the five best-performing midcap stocks of 2022 and how they are poised to perform in 2023.

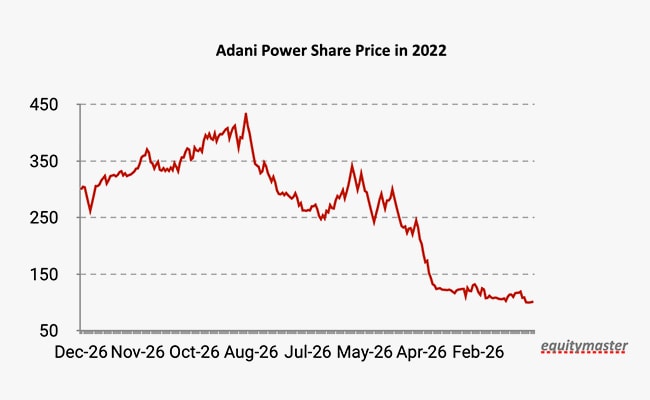

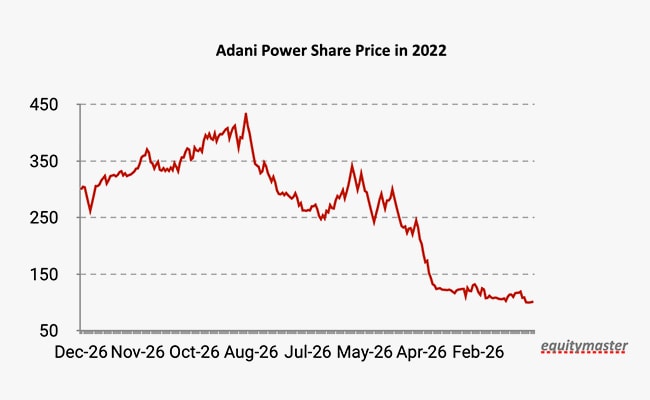

#1 Adani Power

The first stock on the list is Adani Power.

Adani Power rallied 200% in 2022, making it the group's top multibagger stock of 2022.

The surge in the stock came in after the company announced an amalgamation scheme for the merger of its six wholly owned subsidiaries with itself.

These subsidiaries are Adani Power Maharashtra, Adani Power Rajasthan, Adani Power Mundra, Udupi Power Corporation, Raipur Energen, and Raigarh Energy Generation.

The rally in the stock got further support from MSCI (Morgan Stanley Capital International), including Adani Power in its global index.

Adani Power is India's largest private thermal power company. It is a pioneer in setting up a coal-based supercritical thermal power plant in India.

The company's revenue for the September 2022 quarter stood at Rs 84.5 billion (bn), up 51.5% year on year YoY, while net profit increased by 201.6% YoY to Rs 6.9 bn.

The rise in net profit was on the back of higher one-time income, while that for revenue was due to improved tariffs under long-term power purchase agreements on account of higher import coal prices.

In 2023, as a part of the company's expansion plan, the company's Godda power plant will supply 1,600 MW of electricity to Bangladesh.

With the dedicated transmission line, it wants to build large-scale power connectivity with Nepal, Bhutan, and Assam.

Further, the company plans to expand its capacity in Central India through the DB Power acquisition.

DB Power has long and medium-term power purchase agreements for 923.5 megawatts (MW) of its capacity, backed by fuel supply agreements with Coal India, and has been operating its facilities profitably.

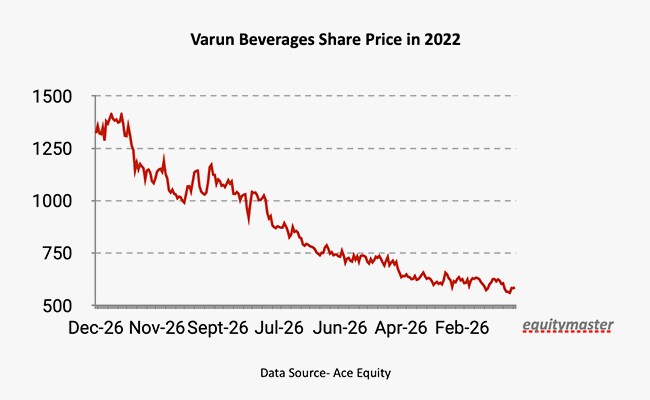

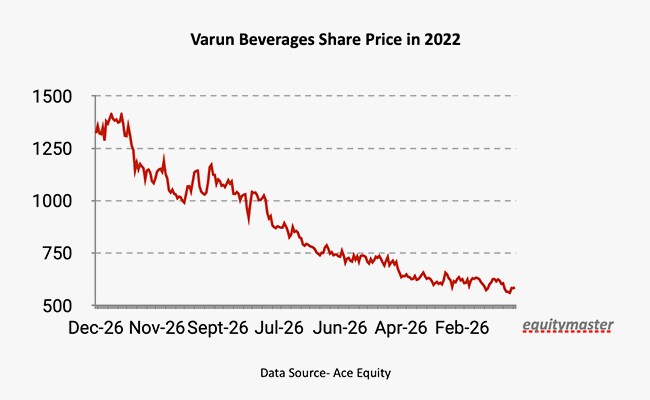

#2 Varun Beverages

Second, on the list is Varun Beverages.

Shares of the company rose 124% in 2022, touching their 52-week high in December 2022. The stock outperformed the Nifty FMCG index, which gained 14% in 2022.

The rally in the stock was on the back of strong earnings momentum, higher acceptance of newly launched products and increased penetration in the newly acquired territories of South and West India.

The rally got further support from PepsiCo's focus on ramping up manufacturing capacity in India by 30-40% till March 2023.

The rally got further support when the company announced a 25% interim dividend of Rs 2.5 per share for the financial year 2023.

Varun Beverages is a large-cap company in India's FMCG sector. With a market capitalisation of Rs 777.5 bn, it is the sixth-largest FMCG giant in India.

The company produces and sells a wide range of carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs).

It is one of the largest PepsiCo franchisees outside of the United States.

For September 2022 quarter, the company reported a 33% YoY rise in revenue to Rs 31.7 bn due to higher realisation on a consolidated basis.

The company's net profit came in 53% YoY higher to Rs 3.9 bn due to 22% organic volume growth over the last year, supported by favourable demand and the strong performance of the energy drink Sting.

The company is in the process of setting up two large greenfield plants in Madhya Pradesh and Rajasthan. It is expanding in Bihar and a few more territories with brownfield plants.

The company hopes to invest Rs 12 bn in capex over the year and plans to grow its capacity by 30%.

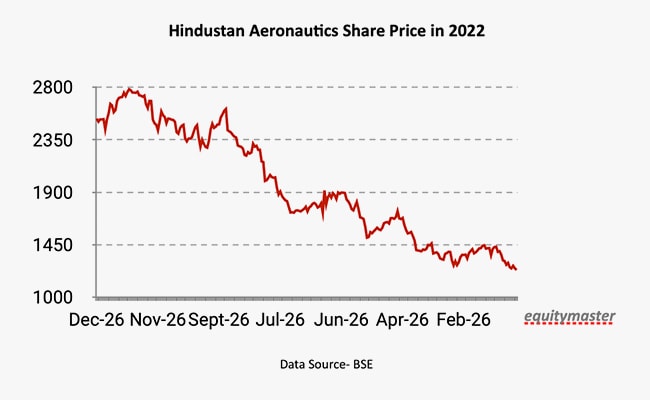

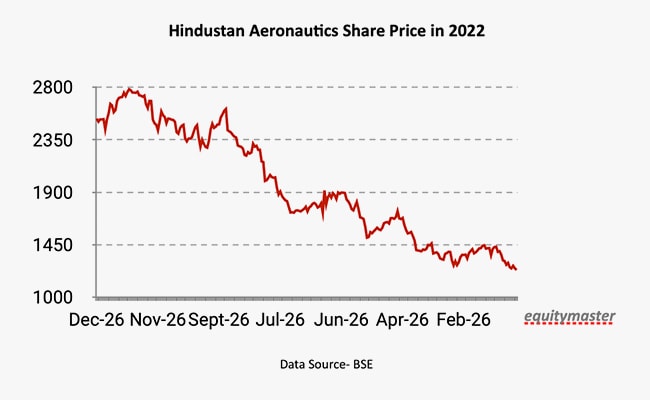

#3 Hindustan Aeronautics

Third on the list is Hindustan Aeronautics.

The stock rallied 109% in 2022, led by enormous deal wins and continuous revenue growth.

The rally was further fueled by the Ministry of Defense (MOD) recent imposition of restrictions on the import of 108 military weapons and systems. This restriction has helped indigenous vendors for defense equipment like HAL, driving the order book to Rs 840 bn.

It expects it to cross Rs 1 trillion by the end of next year, which will last for the next 10-12 years.

Hindustan Aeronautics is an Indian state-owned aerospace and defense company.

The company manufactures and maintains aircraft and helicopters for the Indian Airforce, Indian Army, ISRO, and Indian Navy, among others.

For the September 2022 quarter, the company reported a 7.3% YoY decline in revenue to Rs 51.4 bn due to lower realisations.

Net profit rose over 44% YoY to Rs 12.2 bn, led by large-scale orders in the manufacturing segment and engines.

The company is a debt-free company with no term debt obligations.

The company expects revenue growth of 8% in FY23 and FY24 and double-digit revenue growth from FY25 onwards.

To expand its order book, it is in discussions with Argentina for helicopters order.

It is also developing combat drones for logistical purposes that can carry loads between 5 kg & 40 kg to troops in forward posts.

Apart from this, the company also has a visibility of orders worth Rs 360 bn in the next six months to one year.

HAL has a full-fledged production facility for the manufacturing of cryogenic engines. The company is working in collaboration with Indian Space Research Organisation (ISRO) to manufacture those engines and supply to them.

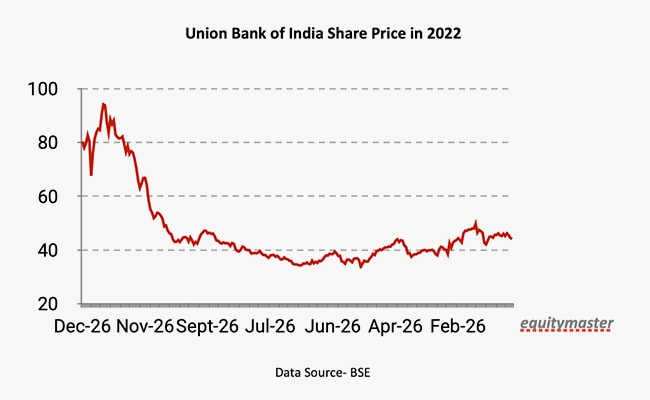

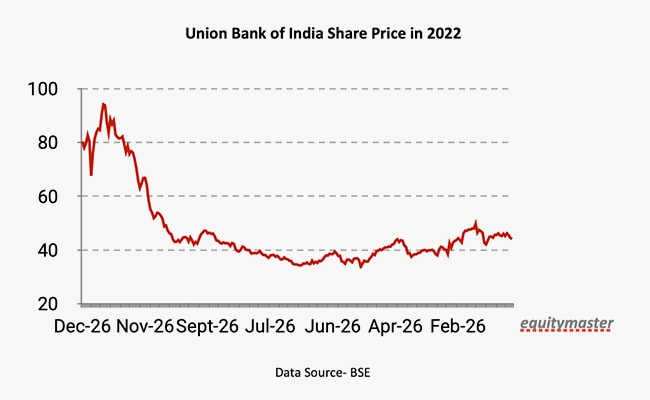

#4 Union Bank of India

Fourth on the list is Union Bank of India.

In 2022, the stock rallied 85%.

The surge in the share price was because of the government's monumental capex plans and improved asset quality.

Union Bank of India is one of the largest state-owned banks in India. The bank also has an international presence with three overseas branches.

For the December 2022 quarter, the lender recorded a net profit of Rs 22.3 bn, doubling from last year's figures of Rs 10.9 bn. This rise was due to a 20.3% rise in net interest income to Rs 86.3 bn.

The bank's gross non-performing asset (GNPA) ratio stood at 7.9%, down from 11.6% last year. The net NPA ratio stood at 2.1%, down from 4.1%.

The bank, at present, is looking forward to raise Rs 35 bn through a qualified institutional placement (QIP).

For the upcoming quarter, it is looking forward to expanding its customer base and picking up speed in the corporate credit cycle.

#5 Indian Hotels Company

Last on the list is the Indian Hotels Company.

The stock rallied over 75% in 2022 on the back of firm demand in the leisure segment and a boost from increased business travel.

Despite a rise in interest rates by various banks, big hotels such as Indian Hotels have not seen a drop in revenue.

It is one of South Asia's oldest and largest hospitality chains and is home to the iconic Taj brand.

With a strong heritage and rich legacy, IHCL has maintained a leadership position in the global landscape of luxury hospitality over the past century.

The company for the September 2022 quarter clocked a revenue of Rs 12.3 bn, up 69.2% YoY, and a net profit of Rs 1.3 bn against the net loss of Rs 1.1 bn in the year ago period.

The strong performance was due to a robust domestic market pipeline, which clocked an over 20% growth rate over pre-Covid levels in India. Its properties in the US, UK, Dubai, and Maldives also registered a strong recovery.

Taking the vision forward, IHCL unveiled Ahvaan 2025 with plans to build a profitable cohort of 300 hotels leveraging its brand equity aligned with high-growth segments.

The target is to reach a 35% EBITDA (earnings before interest, depreciation and amortisation) share contribution from new businesses and management fees by the end of the financial year 2025-2026.

Also, Ama Stays and Trails, one of the company's previous initiatives, looks to expand to 500 properties by the financial year 2026.

Should you invest in midcap stocks?

Investing in midcap companies is gaining traction with investors.

With smallcap stocks being volatile and largecap stocks being relatively slow to grow, midcap stocks offer the best of both worlds as they are less volatile than smallcaps and have more growth potential than largecap companies.

In the long run, midcap companies with strong fundamentals can outperform the market and reward their investors handsomely.

But you shouldn't forget that these companies have had their fair share of volatile periods.

Therefore, before investing in any company, it's important to do thorough research. You must consider all factors, both positive and negative, before investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com

The analogy is, in the stock market, there are largecap stocks with more than 70% of the free-float marketcap getting the spotlight. And then there are underappreciated winners with a marketcap of 12-15%.

Even the most experienced investors sometimes overlook this significant portion of the stock market - midcap stocks.

Just like Goldilocks' chair, midcap stocks are "just right" for investors seeking a balance between growth and profitability.

If your portfolio already holds a lot of smallcap and largecap companies, adding midcap stocks can be just right to diversify your portfolio.

Here's a deeper look at the five best-performing midcap stocks of 2022 and how they are poised to perform in 2023.

#1 Adani Power

The first stock on the list is Adani Power.

Adani Power rallied 200% in 2022, making it the group's top multibagger stock of 2022.

The surge in the stock came in after the company announced an amalgamation scheme for the merger of its six wholly owned subsidiaries with itself.

These subsidiaries are Adani Power Maharashtra, Adani Power Rajasthan, Adani Power Mundra, Udupi Power Corporation, Raipur Energen, and Raigarh Energy Generation.

The rally in the stock got further support from MSCI (Morgan Stanley Capital International), including Adani Power in its global index.

Adani Power is India's largest private thermal power company. It is a pioneer in setting up a coal-based supercritical thermal power plant in India.

The company's revenue for the September 2022 quarter stood at Rs 84.5 billion (bn), up 51.5% year on year YoY, while net profit increased by 201.6% YoY to Rs 6.9 bn.

The rise in net profit was on the back of higher one-time income, while that for revenue was due to improved tariffs under long-term power purchase agreements on account of higher import coal prices.

In 2023, as a part of the company's expansion plan, the company's Godda power plant will supply 1,600 MW of electricity to Bangladesh.

With the dedicated transmission line, it wants to build large-scale power connectivity with Nepal, Bhutan, and Assam.

Further, the company plans to expand its capacity in Central India through the DB Power acquisition.

DB Power has long and medium-term power purchase agreements for 923.5 megawatts (MW) of its capacity, backed by fuel supply agreements with Coal India, and has been operating its facilities profitably.

#2 Varun Beverages

Second, on the list is Varun Beverages.

Shares of the company rose 124% in 2022, touching their 52-week high in December 2022. The stock outperformed the Nifty FMCG index, which gained 14% in 2022.

The rally in the stock was on the back of strong earnings momentum, higher acceptance of newly launched products and increased penetration in the newly acquired territories of South and West India.

The rally got further support from PepsiCo's focus on ramping up manufacturing capacity in India by 30-40% till March 2023.

The rally got further support when the company announced a 25% interim dividend of Rs 2.5 per share for the financial year 2023.

Varun Beverages is a large-cap company in India's FMCG sector. With a market capitalisation of Rs 777.5 bn, it is the sixth-largest FMCG giant in India.

The company produces and sells a wide range of carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs).

It is one of the largest PepsiCo franchisees outside of the United States.

For September 2022 quarter, the company reported a 33% YoY rise in revenue to Rs 31.7 bn due to higher realisation on a consolidated basis.

The company's net profit came in 53% YoY higher to Rs 3.9 bn due to 22% organic volume growth over the last year, supported by favourable demand and the strong performance of the energy drink Sting.

The company is in the process of setting up two large greenfield plants in Madhya Pradesh and Rajasthan. It is expanding in Bihar and a few more territories with brownfield plants.

The company hopes to invest Rs 12 bn in capex over the year and plans to grow its capacity by 30%.

#3 Hindustan Aeronautics

Third on the list is Hindustan Aeronautics.

The stock rallied 109% in 2022, led by enormous deal wins and continuous revenue growth.

The rally was further fueled by the Ministry of Defense (MOD) recent imposition of restrictions on the import of 108 military weapons and systems. This restriction has helped indigenous vendors for defense equipment like HAL, driving the order book to Rs 840 bn.

It expects it to cross Rs 1 trillion by the end of next year, which will last for the next 10-12 years.

Hindustan Aeronautics is an Indian state-owned aerospace and defense company.

The company manufactures and maintains aircraft and helicopters for the Indian Airforce, Indian Army, ISRO, and Indian Navy, among others.

For the September 2022 quarter, the company reported a 7.3% YoY decline in revenue to Rs 51.4 bn due to lower realisations.

Net profit rose over 44% YoY to Rs 12.2 bn, led by large-scale orders in the manufacturing segment and engines.

The company is a debt-free company with no term debt obligations.

The company expects revenue growth of 8% in FY23 and FY24 and double-digit revenue growth from FY25 onwards.

To expand its order book, it is in discussions with Argentina for helicopters order.

It is also developing combat drones for logistical purposes that can carry loads between 5 kg & 40 kg to troops in forward posts.

Apart from this, the company also has a visibility of orders worth Rs 360 bn in the next six months to one year.

HAL has a full-fledged production facility for the manufacturing of cryogenic engines. The company is working in collaboration with Indian Space Research Organisation (ISRO) to manufacture those engines and supply to them.

#4 Union Bank of India

Fourth on the list is Union Bank of India.

In 2022, the stock rallied 85%.

The surge in the share price was because of the government's monumental capex plans and improved asset quality.

Union Bank of India is one of the largest state-owned banks in India. The bank also has an international presence with three overseas branches.

For the December 2022 quarter, the lender recorded a net profit of Rs 22.3 bn, doubling from last year's figures of Rs 10.9 bn. This rise was due to a 20.3% rise in net interest income to Rs 86.3 bn.

The bank's gross non-performing asset (GNPA) ratio stood at 7.9%, down from 11.6% last year. The net NPA ratio stood at 2.1%, down from 4.1%.

The bank, at present, is looking forward to raise Rs 35 bn through a qualified institutional placement (QIP).

For the upcoming quarter, it is looking forward to expanding its customer base and picking up speed in the corporate credit cycle.

#5 Indian Hotels Company

Last on the list is the Indian Hotels Company.

The stock rallied over 75% in 2022 on the back of firm demand in the leisure segment and a boost from increased business travel.

Despite a rise in interest rates by various banks, big hotels such as Indian Hotels have not seen a drop in revenue.

It is one of South Asia's oldest and largest hospitality chains and is home to the iconic Taj brand.

With a strong heritage and rich legacy, IHCL has maintained a leadership position in the global landscape of luxury hospitality over the past century.

The company for the September 2022 quarter clocked a revenue of Rs 12.3 bn, up 69.2% YoY, and a net profit of Rs 1.3 bn against the net loss of Rs 1.1 bn in the year ago period.

The strong performance was due to a robust domestic market pipeline, which clocked an over 20% growth rate over pre-Covid levels in India. Its properties in the US, UK, Dubai, and Maldives also registered a strong recovery.

Taking the vision forward, IHCL unveiled Ahvaan 2025 with plans to build a profitable cohort of 300 hotels leveraging its brand equity aligned with high-growth segments.

The target is to reach a 35% EBITDA (earnings before interest, depreciation and amortisation) share contribution from new businesses and management fees by the end of the financial year 2025-2026.

Also, Ama Stays and Trails, one of the company's previous initiatives, looks to expand to 500 properties by the financial year 2026.

Should you invest in midcap stocks?

Investing in midcap companies is gaining traction with investors.

With smallcap stocks being volatile and largecap stocks being relatively slow to grow, midcap stocks offer the best of both worlds as they are less volatile than smallcaps and have more growth potential than largecap companies.

In the long run, midcap companies with strong fundamentals can outperform the market and reward their investors handsomely.

But you shouldn't forget that these companies have had their fair share of volatile periods.

Therefore, before investing in any company, it's important to do thorough research. You must consider all factors, both positive and negative, before investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com